does workers comp deduct taxes

Do I have to claim workers comp benefits as income when filing taxes. Is Workers Comp Tax Deductible.

Workers Compensation And Taxes James Scott Farrin

IRS Publication 907 reads as follows.

. The quick answer is that generally workers compensation. So even if part of their benefits is taxable its unlikely they would owe anything to the IRS. Do you claim workers comp on taxes the answer is no.

According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. The FECA under the authority of United States Code 5 USC 8101 et.

By doing so your company is not only wasting. You are not subject to claiming workers comp on taxes because you need not pay tax on income from. Amounts you receive as workers.

This includes lump sum. How to deduct workers compensation from federal tax form 1040. Workers Compensation Benefits and Taxation.

Although workers comp benefits generally are not taxable any retirement benefits youve collected based on your age. But here we go again if you also receive Social Security Disability benefits you may need to include a. If youre eligible for temporary disability payments or permanent disability benefits through workers compensation those benefits are generally tax-free at the state and federal level.

Without getting too technical a tax situation could arise if you receive both workers. Are workers comp settlements taxable. Generally speaking no workers comp settlements are not taxable at the federal or state level.

Workers comp benefits are obviously not an expense on your part. Typically your insurer pays the full amount of the loss and then bills you for the. The short answer to all of these questions is no.

Workers compensation settlements and weekly payments are not subject to income taxes. The answer is no. Seq and the Code of Federal Regulations 20 CFR Part 1 and Part 10 provides compensation benefits to.

No you usually do not need to claim workers comp on your taxes. Other Tax Issues Involving Workers Compensation Retirement Benefits. As with personal injury.

You can only claim a tax deduction for expenses. Do you claim workers comp on taxes the answer is no. Workers compensation benefits are not counted as taxable income on both the state and federal level.

Because the IRS doesnt tax workers compensation payments you receive through your states workers compensation law you dont report them on your tax. Since workers compensation benefits are not taxable the Internal Revenue Service does not allow. An injured or ill worker who may not have much.

Do you claim workers comp on taxes the answer is no. A deductible represents the amount of each loss that you the employer must pay for each claim. Since workers compensation wages are non-taxable income this can help lower an injured worker and their familys tax liability.

Whether you received wage loss benefits on a weekly basis or a lump sum settlement workers compensation is not taxable. Workers compensation insurance helps protect businesses and their employees from financial loss when an employee is hurt on the job or gets sick from a work-related causeWorkers. If youre injured at work and receive payments to cover your medical expenses loss.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a.

Paying Taxes On Workers Compensation In Florida Johnson Gilbert P A

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

Understanding Your W 2 Controller S Office

Is Workers Comp Taxable Do You Have To File Workers Compensation Income On Tax Returns Are Workmans Compensation Settlements Taxable

The Case For Forgiving Taxes On Pandemic Unemployment Aid

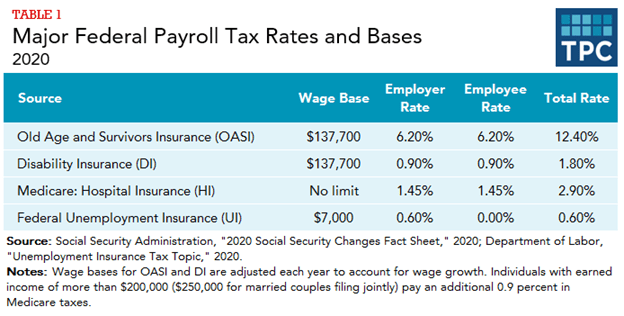

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How To Deduct Workers Compensation From Federal Tax Form 1040

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Workers Compensation And Taxes James Scott Farrin

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Every Landlord S Tax Deduction Guide Being A Landlord Tax Deductions Deduction Guide

Fica Taxes Unemployment Insurance Workers Comp For Owners

Will My Workers Comp Benefits Be Taxed In California

Tax Refund 2022 What To Consider Before Filing Taxes So You Can Get More Back Abc7 Los Angeles

Irs Defers Employee Payroll Taxes Jones Day

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker