cares act stimulus check tax refund

The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. Rather than filing an amended 2018 return to claim the credits the CARES Act allows the taxpayer to file an application for a tentative refund quickie refund by December 31 2020 to claim its remaining MTCs for its 2018 tax year.

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

The IRS says it is no longer deploying 1400 stimulus checks and plus-up payments that were due to qualifying Americans in 2021.

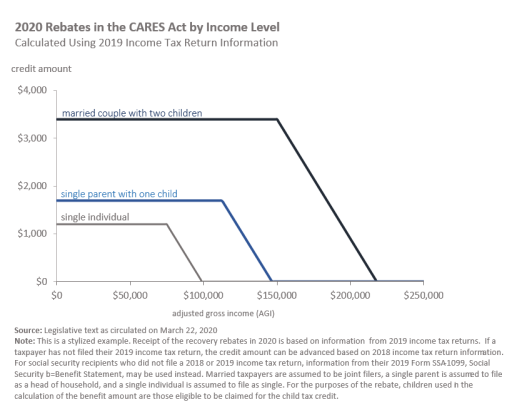

. Because youre getting what amounts to a refundable tax credit now in the form of a third stimulus payment rather than waiting to get the money from the credit in 2022 when you actually file your 2021 tax return youre in effect. The spending primarily includes 300 billion in one-time cash payments to. Up to 75000 if single or you filed taxes married filing separately.

The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Whoever claimed the children. Up to 112500 if you filed as head of household.

2019 tax returns they look at age as of. If you received any stimulus check or got a direct deposit of economic impact payments EIP or through a stimulus EIP Debit card a question may hover if the payment will actually increase your tax or reduce your expected tax refunds during the year 2021. Because business owners claim it on their quarterly employment tax return Form 941 the CARES Act benefit isnt reported on their income taxes for their business.

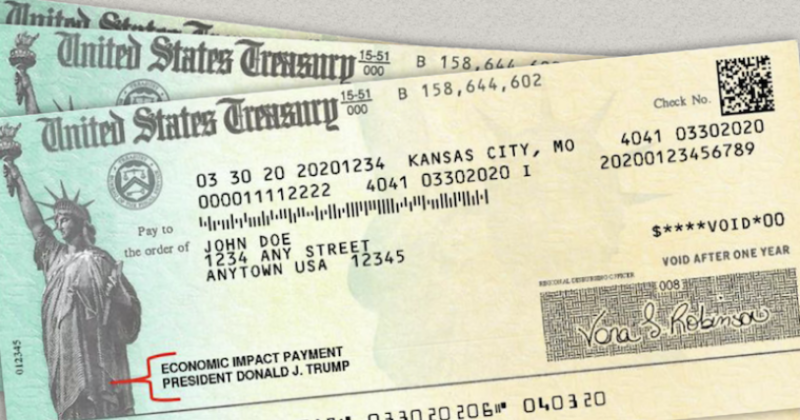

Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID-19 pandemic in the United States. You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of. Employee Retention Credit ERC The ERC was designed to help keep employees on the job by allowing business owners to claim a payroll tax credit.

Committees of Congress. If tax refund or tax owed was mailed a check will be mailed between May and September. People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return.

Here are four things to know about the CARES Act. Yes as indicated in our prior alert about the stimulus package individuals will be eligible for recovery rebates more particularly the cares act provides for a 1200 refundable tax credit for individuals 2400 for joint taxpayers. How To Check Irs Stimulus RefundDitto for all three stimulus checks.

And for each child under the age of 17 parents will get 500. The Act provides a stimulus tax credit for eligible people and instructs the IRS to issue stimulus checks to eligible individuals as soon as possible. As a result of the CARES Act which became law on March 27 2020 most Americans will receive stimulus checks.

CARES ACT STIMULUS PAYMENTS FOR PEOPLE IN JAIL OR PRISON October 2020 In March 2020 the US. 116-136 enacted March 27 2020 includes direct payments to individuals in 2020referred to by the Internal Revenue Service IRS as. If you no longer have access to a copy of the check call the IRS toll-free at 800-829-1040 individual or 800-829-4933 business see telephone and local assistance for hours of operation and explain to the assistor that you need information.

Funds will be sent via Direct Deposit or Check Mailed. In IRS Refund. CARES Act Economic Impact Payments.

CARES Act Coronavirus Relief Fund frequently asked questions. The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return. The plain and simple answer to that question is that stimulus payments are tax-free.

The location is based on the city possibly abbreviated on the bottom text line in front of the words TAX REFUND on your refund check. This form can be filed immediately to accelerate to refund. You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check.

However there may still be people eligible for those checks or. Single taxpayers will get 1200. They could have received more if theyre married or have children.

They were issued in 2020 and early 2021. There are income limitations to receiving a stimulus check see below but the amount you will receive is 1200 for a Single taxpayer or 2400 for a married filing joint taxpayer. When the cares act created the first stimulus check it relied on your 2018 or.

Married taxpayers will get 2400. Updated April 24 2020. Congress passed the Coronavirus Aid Relief and Economic Security Act CARES Act.

Under the law the Fund is to be used to make payments for specified uses to States and certain local governments. Up to 150000 if married and you filed a joint tax return. The Coronavirus Aid Relief and Economic Security Act CARES Act.

Child Tax Credit payments and Recovery Rebate Credits can make delay refunds. The IRS tax deadline for 2021 returns is April 18 for most states. If direct deposit or debit was used when taxes were filed stimulus check will be direct deposited and received by April 20th.

The Child Support Federal Tax Offset of. For example if you owed 1000 in taxes but had a refundable tax credit of 1200 youd get a 200 tax refund check from Uncle Sam. Of course there are some stipulations.

An additional amount of 500 per dependent child age 16 and younger at the end of the year of the tax return they are looking at will be sent as well ex.

Filing Your Taxes Soon Here S How Covid 19 Stimulus Could Affect What You Owe

Coronavirus Irs Sends Stimulus Checks To Deceased Americans Warns Relatives Forgery Is A Federal Crime Abc7 San Francisco

Will My Stimulus Check Be Affected If I Owe Taxes Or Child Support Your Coronavirus Money Questions Answered

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

Nonresident Guide To Cares Act Stimulus Checks

Faqs Can My Father S Nursing Home Take His Stimulus Check Estate And Probate Legal Group Estate And Probate Legal Group

Irs Urges Non Filers To Register To Get Stimulus Checks By Year End

Average Tax Refund Up 11 In 2021

Mayor Latoya Cantrell The Federally Passed Cares Act Includes The Individual Stimulus Payment Officially Titled The 2020 Recovery Rebate For Individuals It Means That The Government Will Issue Checks That Are

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Will The Stimulus Money Be Deducted From Your Refund Next Year 11alive Com

Stimulus Payments May Be Offset By Tax Debt The Washington Post

How The Recent Stimulus Checks Affect Your Ssdi Benefits Call Sam

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Key Dates For The Next Set Of Stimulus Payments The Washington Post